Are Joint-Venture Brands Returning with Transmissions — And Will They Lead a New Trend in EV Development?

Catalog

1. Background: Why “EV + Gearbox” Has Become a Hot Topic

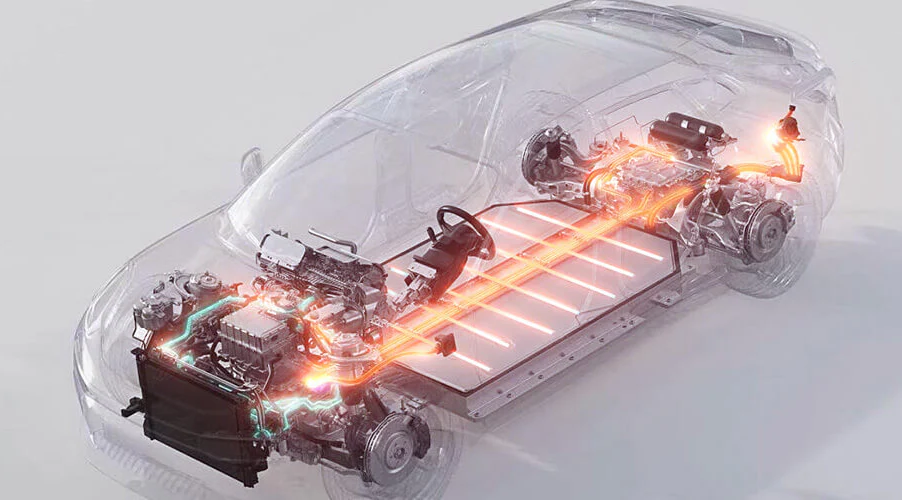

For a long time, a hallmark of mainstream electric vehicles (EVs) has been simplified drivetrain architecture: motor → reduction gear → wheels, typically in a single fixed ratio (i.e. a “single-speed gearbox”). This design is simple, low in cost, and reliable — hence its widespread adoption.

However, in recent years, automakers and parts suppliers have renewed interest in the feasibility of multi-speed gearboxes in EVs. Media and industry watchers have reported that some high-performance EVs have begun adopting two-speed (or more) transmissions — for example, Porsche Taycan’s two-speed drive, Audi e-tron GT’s dual-speed layout, and Lotus Eletre’s attempts with transmissions in its top versions. In China, there have also been reports that this route is being used by joint-venture brands as a breakthrough to “return to the EV market via the gearbox.”

Moreover, some automakers/groups (e.g. Stellantis) have filed for or obtained patents/technical proposals for multi-speed EV gearboxes (such as three-speed electric drive reducers) to enhance adaptability and efficiency across various driving conditions. In external market and investment reports, it is projected that the future market size for EV gearboxes could expand significantly.

Hence, behind this “return” movement lies both technical exploration and a strategic intention by joint-venture automakers to seek differentiation in the EV arena. But whether this trend can truly dominate future EV development requires scrutiny through the lenses of technology, cost, market, and consumer behavior.

2. Why Would an EV “Return” to Gearboxes? Mechanisms and Motivations

To assess whether this trend has the potential to lead the industry, we first need to understand: what value does a gearbox bring in an EV? Under what conditions does it deliver real improvement? And what physical or engineering logic supports it?

2.1 Theoretical Basis: Matching the Motor with the Gearbox

Compared to internal combustion engines, electric motors have these distinguishing traits (and also reasons why gearboxes are not commonly used):

Good torque output from low speed: Electric motors can deliver substantial torque even from zero RPM, enabling “instant start.”

Wide efficient speed range: Within a certain range, motor efficiency is relatively stable; they are not as sharply sensitive to speed as fuel engines.

Weak shifting demand: For many everyday conditions (city low speed, acceleration, cruising), a single-speed transmission is sufficient.

Based on these features, a single-stage reduction mechanism became the mainstream choice. However, that doesn’t imply it’s always optimal. The potential value of multi-speed gearboxes primarily lies in these scenarios:

Efficiency improvement at high speed: When driving at high speed, if the motor spins fast, iron-core losses and other electromagnetic losses intensify. A gearbox can reduce the motor speed while maintaining high vehicle speed, thus mitigating motor losses and possibly improving efficiency during high-speed cruising. Several analyses and research papers support this direction.

Performance enhancement: For performance-oriented models, a multi-speed gearbox can use a lower gear for starting or torque amplification, and a higher gear for high-speed stages — balancing acceleration performance and top speed. This is especially meaningful for sports or performance EVs.

Motor size/spec optimization: If different gears can optimize efficiency for different working conditions, it may be possible to use a relatively lower-power motor combined with a gearbox to satisfy multi-condition demands, achieving a compromise in cost, size, and weight.

Strategic differentiation: For some automakers (especially joint-venture brands or legacy automakers transitioning to electrification), gearboxes represent a legacy from the internal combustion era. Incorporating gearbox technology into EVs becomes a way to preserve technical heritage and become a product feature, providing consumers with a sense of “familiarity” or a perception of “traditional automaker’s technical depth.”

In short, the introduction of gearboxes in EVs is not because EVs inherently “need” them, but because under certain conditions, they may bring marginal gains in efficiency, performance, or brand image.

2.2 Constraints & Challenges: Where Are the Costs?

Introducing a gearbox is not without trade-offs. The main challenges include:

Cost and complexity: Multi-speed gearboxes are more complex than single-speed structures, requiring clutches, gear sets, controllers, synchronizers, etc., which raise manufacturing and maintenance costs.

Transmission efficiency losses: Each gear stage, clutch engagement, and shift may introduce mechanical friction and energy loss; if design or control is poor, these losses might offset the efficiency gains.

Shift shock & drive smoothness: Gear shifting can cause jerks or torque interruptions, a sensitive issue for EV user experience. In theory, some studies point out that “no-jerk shifting” may have inherent limits in certain multi-speed structures, especially when motors or actuators saturate.

Weight & volume increase: Beyond the gearbox itself, related lubrication systems, cooling systems, structural reinforcement, etc., may add mass and space requirements.

Control complexity increase: Shift logic, E-control coordination, thermal management, motor-gear matching — all these require more design investment and tuning.

Limited applicability: For vehicles that mainly operate at low speeds or urban commuting (typical for many family EVs), the proportion of high-speed driving is low, and the efficiency benefits from gearboxes may not materialize, making widespread adoption less meaningful.

Therefore, whether the introduction of gearboxes is “worth it” depends on whether the marginal gains in real usage scenarios can cover these costs.

3. Why Do Joint-Venture Brands Choose the “Gearbox Return” Path? Strategic Logic Behind It

Given the risks of introducing gearboxes, why would joint-venture brands use this route as a breakthrough? Here are some possible strategic considerations:

3.1 Bridging Technical & Brand Continuity

Joint-venture automakers (like Volkswagen, Toyota, Honda, GM, Nissan in China) have deep accumulation in transmissions, combustion engines, chassis tuning, whole-vehicle integration. Compared with many new EV-only brands, they possess richer experience in powertrain systems. By retaining or upgrading the “gearbox” element in EVs, they can both preserve technical lineage and shape a brand impression of “traditional automaker engineering strength.”

For some consumers, “EVs without gearboxes” may psychologically feel disconnected from gasoline cars. Joint-ventures may attempt to use “EVs with gearboxes” as a marketing point — signaling technical continuity, reliability, and heritage.

3.2 Differentiation Strategy

Facing fierce competition from domestic independent brands, joint-venture automakers suffer from a “late entrant disadvantage” in the EV space. In power, battery, range and other core technical dimensions, many independent brands have substantially caught up or overtaken. If joint-ventures continue competing head-on in these dimensions, they may be at a disadvantage.

Introducing gearboxes as a selling feature enables differentiation in product characteristics (e.g. performance, energy consumption, brand technical recognition). In short-term marketing or high-end model positioning, this could bring some appeal.

3.3 Exploring Future Hybrid Structures: Evolving from “Traditional Hybrid to Electric Hybrid”

Some joint-ventures already have accumulation in hybrid or plug-in hybrid technologies. If their EV strategies in the future are to maintain linkage with hybrid or extended-range systems, then continuity in technical paths may make them more willing to keep a gearbox module, allowing more flexible architectures for powertrain switching or hybrid scenarios.

3.4 Risk Hedging: Multi-Path Technology Layout

Amid the electrification wave, there is yet no universally recognized optimal electric drive architecture. For legacy automakers, a conservative strategy is to deploy multiple technology paths in parallel: single-speed, multi-speed, hybrid/plug-in/extended-range. The “gearbox return” may be their hedge in the “high-performance, high-speed-efficiency” path.

4. Industry Progress & Case Studies

Stellantis three-speed electric drive reducer: In 2025, Stellantis obtained a U.S. patent for a three-speed electric drive reducer. Using planetary gear sets and multiple friction clutches, it offers three gears, aimed both at improving off-road towing performance and optimizing cruising efficiency.

Porsche Taycan / Audi e-tron GT: These premium models use two-speed transmissions, adding some performance and range advantage in high-speed or extreme acceleration scenarios.

R&D investment by Volkswagen / Stellantis / other groups: Reports indicate that Stellantis is testing multi-speed transmissions to boost EV efficiency.

Though these cases have not yet reached mass commercial adoption, they demonstrate that this direction is receiving attention and investment within the industry.

5. Trend Assessment: Can Gearbox Return “Dominate” EV Development?

Bringing together the technical and industrial landscape, here are some judgments:

5.1 Low Probability of Dominance, but High Probability as an “Important Branch”

In the near term, mainstream EV tech will still lean toward simplicity, high reliability, and low cost — i.e. single-speed electric drive architectures. Most family EVs operate mainly in urban roads, low-speed, frequent stop-and-go, while high-speed phases are a smaller fraction. Under this usage pattern, the efficiency gains from multi-speed gearboxes may not justify their costs and complexity.

Hence, the return of the gearbox is more likely to become a competitive branch route in the EV technology ecosystem, mainly playing a role in performance, luxury, or scenario-extreme models — rather than becoming the uniform mainstream overnight.

5.2 Trigger Conditions & Market Stratification Could Accelerate Pilots & Adoption

For the gearbox return to advance, a number of trigger conditions need to be met:

Higher share of high-speed usage: If user demand for high-speed cruising, intercity travel, and long-range scenarios grows, the efficiency improvements from gearboxes will become more salient.

Cost reduction & technology maturity: As multi-speed electric drive, clutch control, lightweight designs, and control algorithms mature, cost and complexity must be pushed down significantly.

Control logic & software optimization: Shift strategy, coordination with motor, energy recovery, and thermal systems must be deeply integrated; otherwise, control inefficiencies may counteract the gains.

Vehicle platform adaptation: Future EV platforms must pre-design space for multi-speed modules, coupling structures, cooling/lubrication interfaces, etc.

Consumer willingness to pay: Automakers must package the gearbox as a differentiation point convincingly, so that consumers are willing to pay for performance/efficiency benefits.

If these conditions align, joint-venture automakers — motivated by brand, technology continuity, and differentiation — could push this path at scale, potentially gaining strong influence in certain market segments.

Conclusion: Is the Return of Gearboxes a Regression or Evolution?

From a technical standpoint, joint-venture brands re-equipping EVs with gearboxes is not a step back to the internal combustion era, but rather an attempt to further optimize the electric drive system’s performance. It reflects the auto industry’s renewed push to push the “efficiency frontier.”

From an industrial-competitive perspective, Chinese new energy automakers’ advantages in motors, control electronics, and batteries are already strong enough to substitute mechanical transmission in most use cases. The future battle will be won by those who can balance performance, cost, and efficiency.

Thus, the “return” of gearboxes is better seen as a diversified exploration rather than a technical detour. The future of electric drive may come from Porsche’s two-speed innovations … or from BYD’s smart control systems. Whichever path wins out, they are jointly driving — and accelerating — the ongoing evolution of EV powertrain technology.

Please explore our blog for the latest news and offers from the EV market.