The Breakthrough Road of Solid-State Battery Technology: How China Leads the Next-Generation Energy Race

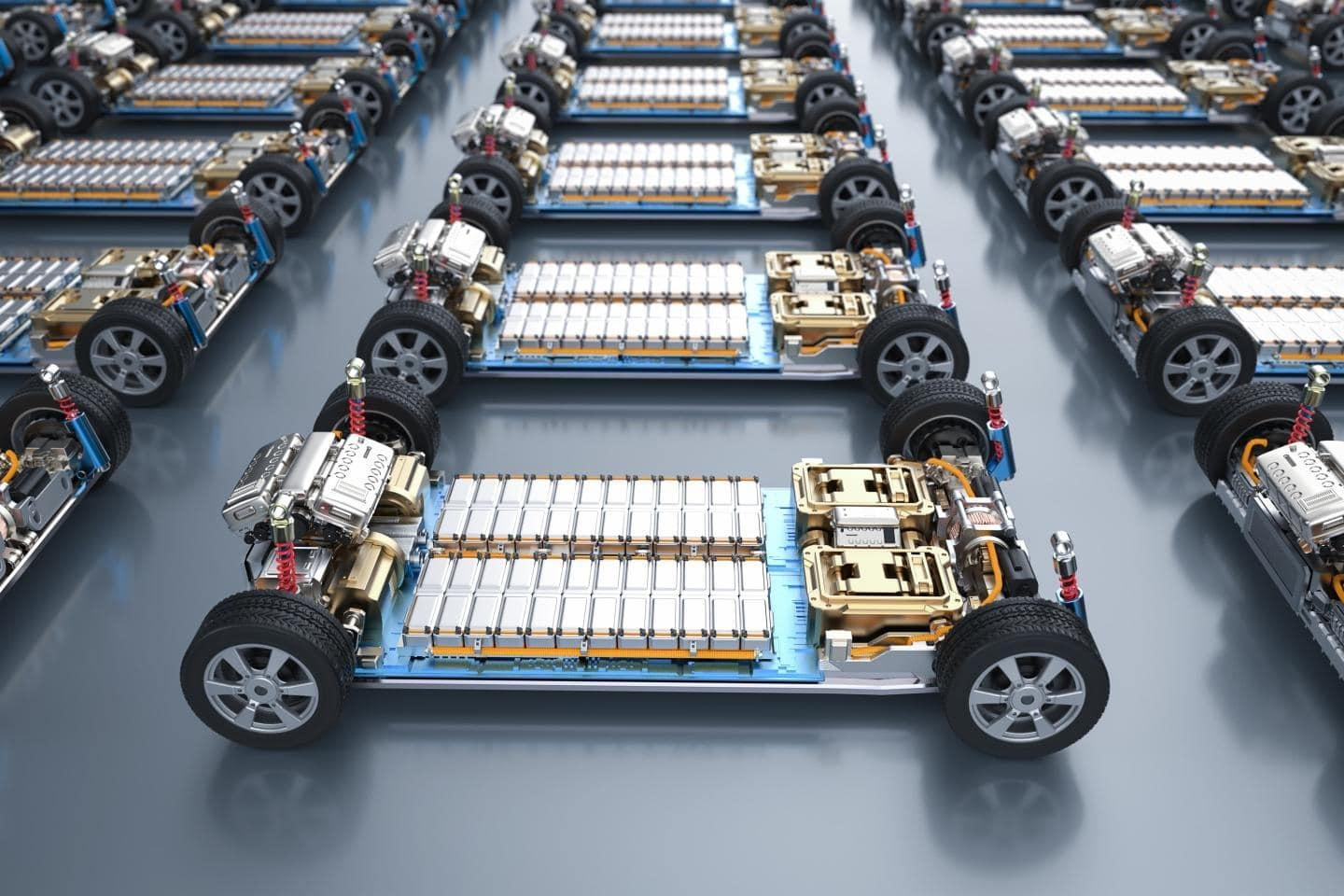

At the Start of 2025, Solid-State Battery Technology Sees Intensive Breakthroughs. From BYD and CATL to GAC and Huawei, industry giants are making bold moves, accelerating an energy revolution that is set to disrupt traditional lithium-ion batteries. Behind this technological race lies not only competition for a trillion-dollar market but also a transformation in the future landscape of new energy vehicles (NEVs), energy storage, and low-altitude economy sectors. This article provides an in-depth analysis of solid-state battery technology and exclusive insights into Chinese companies’ strategic planning and industrialization timelines.

Catalog

1. In-Depth Analysis of Solid-State Battery Technology: From Basic Principles to Disruptive Innovations

1.1 Definition: A Foundational Innovation in Battery Design

Structural Limitations of Traditional Lithium-Ion Batteries

Traditional lithium-ion batteries rely on liquid electrolytes, composed of:

Cathode (NMC/LFP) ↔ Separator (Polyethylene) ↔ Anode (Graphite) ↔ Electrolyte (LiPF6 solution)

Key Drawbacks:

Flammable and volatile electrolytes

Lithium dendrite growth causing short circuits

Energy density approaching theoretical limits (~300Wh/kg)

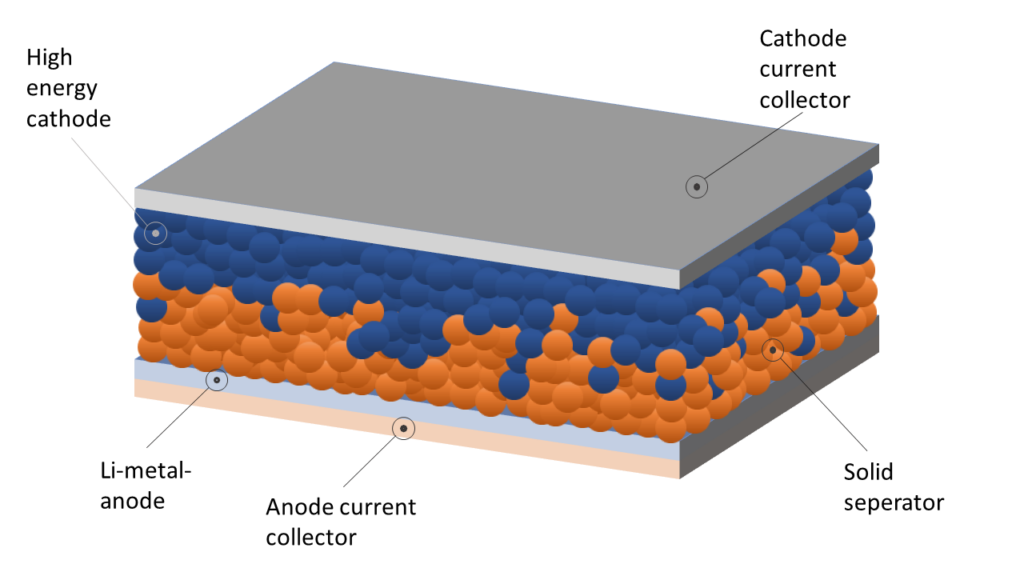

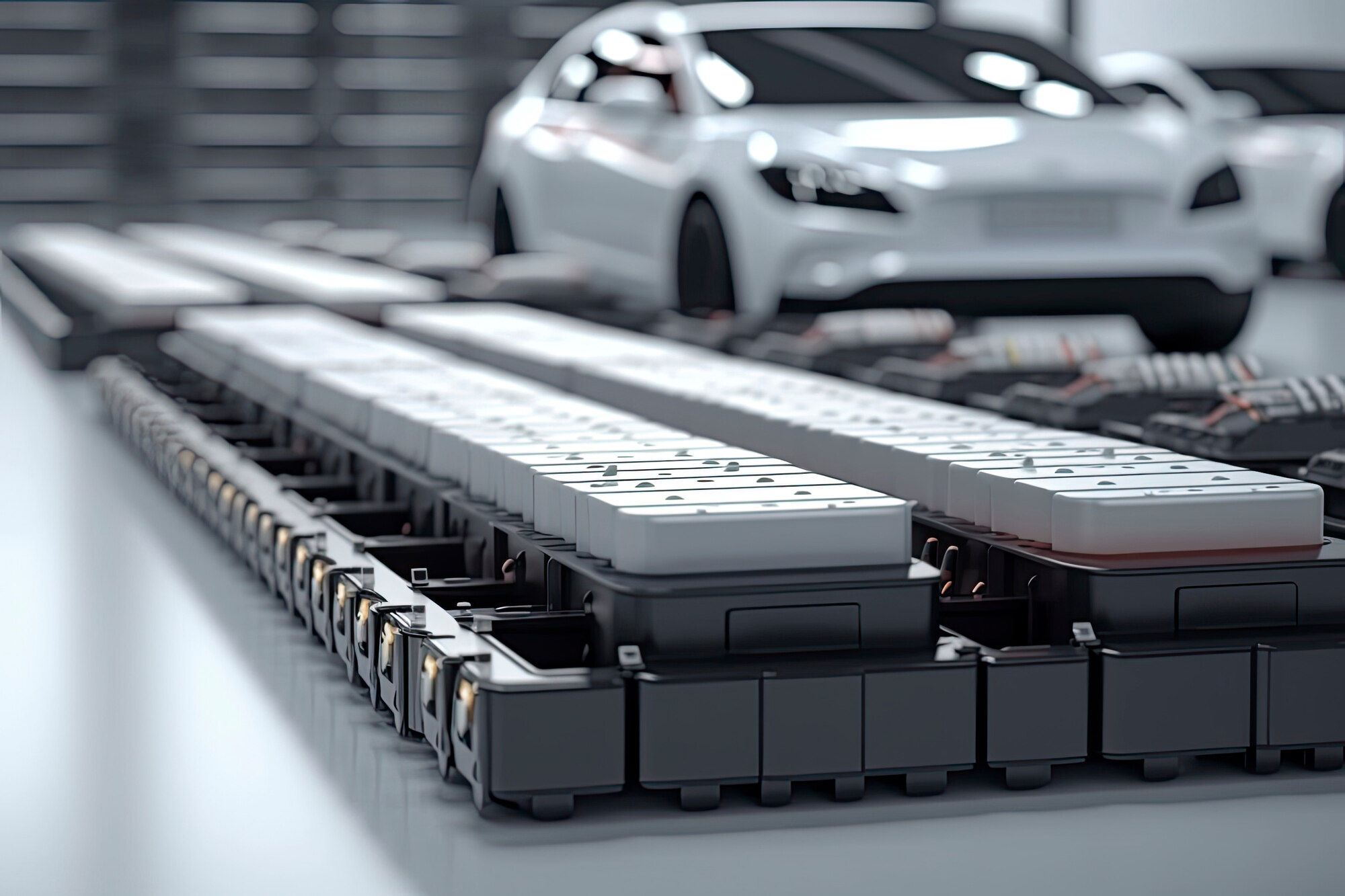

Structural Revolution of Solid-State Batteries

A three-component redesign:

Electrolyte: Solid materials (sulfides, oxides, or polymers) replace liquid electrolytes

Anode: Graphite → Lithium metal (10× capacity increase, reaching 3860mAh/g)

Separator: Removed or replaced with an ultra-thin solid electrolyte layer

Working Principle:

Charging: Lithium ions migrate from the cathode, pass through the solid electrolyte, and deposit onto the lithium-metal anode

Discharging: Lithium ions reverse their migration, generating electricity through an external circuit

1.2 Key Technological Breakthroughs: Four Dimensions of Innovation

| Dimension | Liquid Lithium-Ion Battery | Solid-State Battery | Core Physical Improvement |

|---|---|---|---|

| Ion Conductivity | Liquid diffusion (0.1-1 mS/cm) | Solid lattice conduction (up to 10⁻² S/cm) | Sulfide crystal defect channel optimization |

| Interface Contact | Liquid wetting (low impedance) | Solid-solid contact (higher impedance) | Nano-interface modification technology |

| Energy Density | Graphite anode (372mAh/g) | Lithium-metal anode (3860mAh/g) | Anode material revolution |

| Thermal Management | Electrolyte boiling point < 200°C | Electrolyte melting point > 500°C | Improved thermodynamic stability |

1.3 Solid Electrolyte Material Strategies: A Three-Way Competition

(1) Sulfide-Based Electrolytes: High Performance, High Complexity

- Leading Players: CATL, Toyota

- Key Material: Li₂S-P₂S₅ (Ionic conductivity ~10⁻³ S/cm)

- Breakthrough: CATL’s Li₃PS₄-Cl composite electrolyte improves air stability by 300%, enabling over 1000 charge cycles

(2) Oxide-Based Electrolytes: The Cost-Effective Choice

- Variants:

- Thin-film type: LiPON (used in Apple Watch and micro-devices)

- Thick-film type: LLZO (Lithium Lanthanum Zirconate, mainstream for EVs)

- Chinese Companies:

- BYD developing LAGP (Li₁.₅Al₀.₅Ge₁.₅(PO₄)₃) electrolyte

- Qingtao Energy achieving LLZO electrolyte mass production (91% yield)

(3) Polymer-Based Electrolytes: Manufacturing-Friendly but Performance-Limited

- Material System: PEO (Polyethylene oxide) + lithium salt

- Temperature Constraint:

- Ionic conductivity at room temperature: ~10⁻⁵ S/cm

- Requires heating to 60°C for proper function

- Innovation Efforts:

- Huawei using AI-assisted molecular design to develop new PVDF-based composite electrolytes

- Weilan New Energy launching gradient “polymer-inorganic” electrolytes

1.4 Performance Comparison (2024 Data)

- Charging Speed: 80% charge in 10 minutes (vs. 30 min for liquid batteries)

- Cycle Life: Retains over 90% capacity after 1000 cycles

- Temperature Adaptability: Operates stably between -40°C and 120°C (vs. -20°C to 60°C for liquid batteries)

2. From Lab to Mass Production: The Solid-State Battery Roadmap

2.1 Sulfide Electrolyte Route Leads the Race

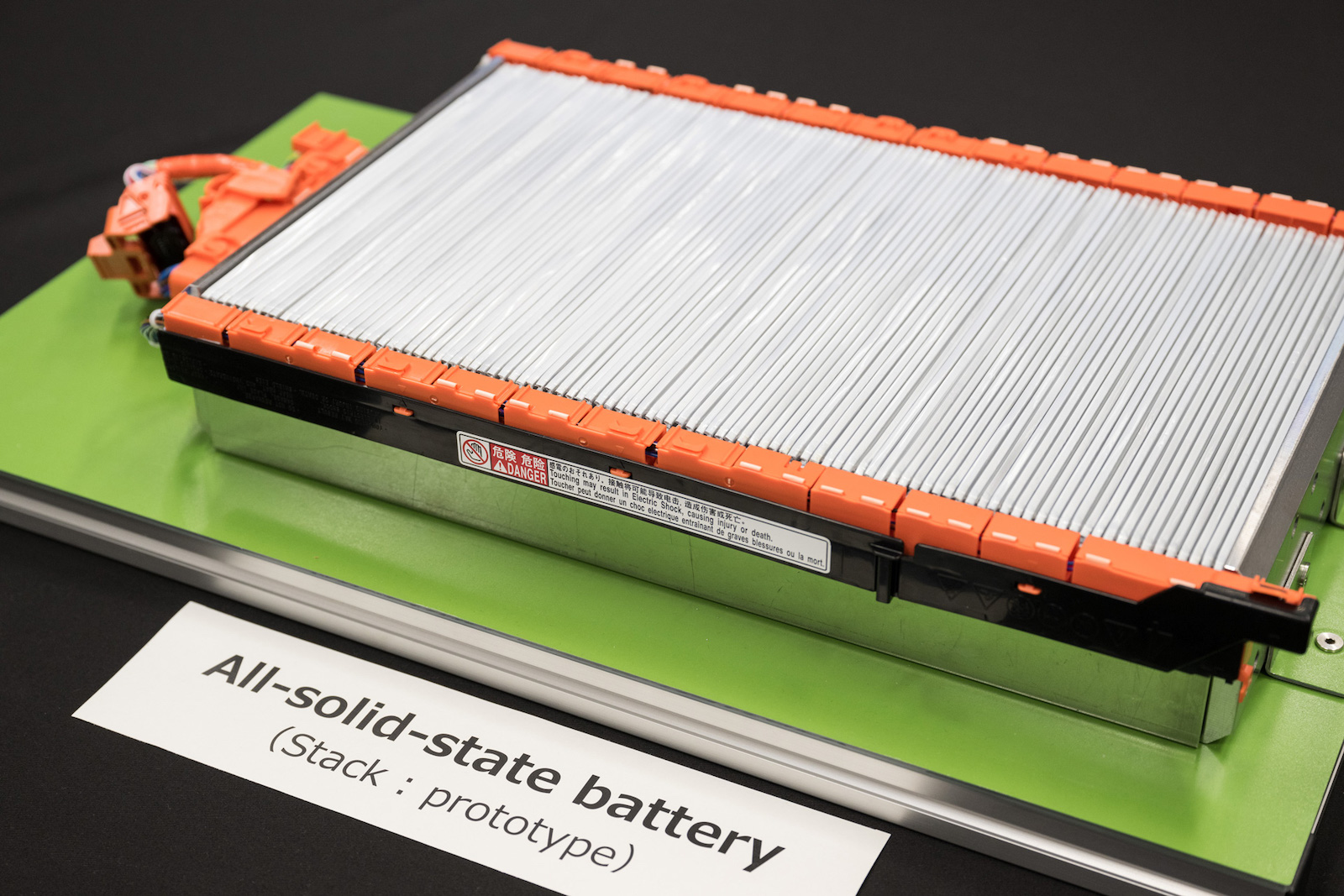

- 2025-2027: First-gen solid-state batteries enter mass production (~400Wh/kg, >1000 cycles), targeting premium EVs

- 2027-2030: Second-gen achieves 500Wh/kg, costs reduced by 30%, expanding to mid-range models

- Post-2030: Third-gen aims for 600Wh/kg, eliminating range anxiety entirely

2.2 Breakthrough in Separator-Free Technology

- Chongqing Tailan New Energy announces separator-free solid-state battery technology, improving safety while lowering production costs

3. Industry Competition: BYD, CATL, and Huawei’s “Three-Pillar” Strategy

- BYD: Evaluating full industrialization feasibility; aims for 2026 vehicle trials.

- GAC Group: Full-process solid-state battery technology ready; plans to integrate into Hyper GT in 2026, targeting 1000km range.

- CATL: Scaling up development, forming an “All-Solid-State Battery Manufacturing & Equipment Alliance” to standardize industry practices.

- Huawei: Patent approval signals potential entry into the automotive battery supply chain.

4. Safety Revolution: The End of “Battery Fire” Concerns

Solid-state batteries’ most significant advantage isn’t just higher energy density but superior safety:

- Zero leakage risk: No flammable liquids, eliminating puncture and collision-induced fire hazards

- Improved thermal stability: 50% less performance degradation in extreme conditions (-30°C or high heat), ideal for aerospace and polar exploration

- Extended lifespan: 2× longer cycle life than liquid batteries, significantly reducing energy storage system replacement costs

5. Industrialization Challenges: Costs, Manufacturing, and Supply Chain Bottlenecks

Despite rapid technological progress, three major hurdles remain:

- High material costs: Sulfide electrolytes (e.g., lithium sulfide) cost 5× more than liquid electrolytes, requiring mass production for cost reduction

- Complex manufacturing: Solid-state batteries demand new electrode-electrolyte interface techniques, and current production lines lack compatibility

- Supply chain integration: Chinese Academy of Sciences urges establishing “common fundamental materials supply chains” to avoid redundant R&D efforts

6. Future Outlook: A Trillion-Dollar Market by 2030

According to Securities Daily, solid-state battery commercialization will occur in three phases:

- 2025-2027: Semi-solid batteries debut in premium EVs and drones (Market size: ¥200 billion)

- 2027-2030: Full solid-state batteries scale up; penetration rate exceeds 10%, triggering an upstream and downstream industry boom

- Post-2030: Costs fall to 1.2× of liquid batteries, enabling full replacement and ushering in a “long-range + absolute safety” era

The golden decade of solid-state batteries has begun! This technology will redefine not only the automotive industry but also energy storage and smart grid sectors. As Chinese companies pursue full-supply-chain innovation, those who lead in materials, manufacturing, and supply chains will secure an unbeatable position in this trillion-dollar market.

Please explore our blog for the latest news and offers from the China car market.