Sales Review of China's Emerging EV Makers in 2024: Breakthroughs and Challenges

As December draws to a close, the annual performance of Chinese automakers is finalized. Reflecting on 2024, a year dominated by a relentless “price war,” several automakers exited the market, highlighting the harsh reality of China’s automotive industry. However, despite these challenges, the results published by emerging EV brands show continued growth. Amid this growth, significant shifts in market dynamics have already begun to unfold.

Catalog

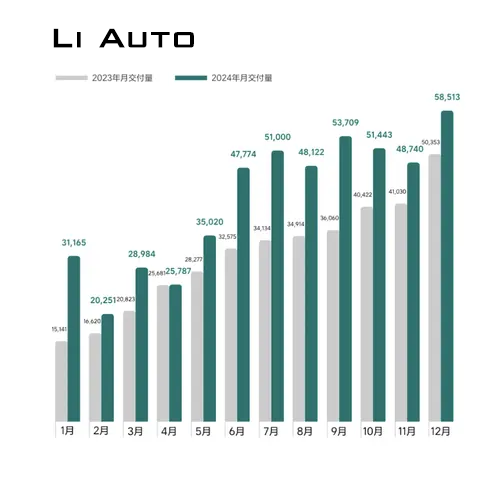

1. Li Auto Leads with Extended-Range Advantage

In the 2024 sales ranking of emerging EV makers, Li Auto claimed the top spot with 58,513 units sold in December and a total of 500,508 units for the year. Although its first pure EV model, the MEGA, faced major setbacks, Li Auto’s core lineup of extended-range models (L6, L7, L8, L9) performed exceptionally well. This allowed the brand to outpace rivals such as NIO and XPeng and compete with premium players like BMW, Mercedes-Benz, and Audi in niche markets.

Analysis:

Li Auto’s impressive performance is attributed to its precise market positioning and product strategy, particularly its leadership in extended-range technology. While competitors have started introducing extended-range models, Li Auto’s first-mover advantage has solidified consumer trust and loyalty. However, as Li Auto ventures into pure EVs in 2025, whether it can maintain consumer favor remains uncertain. Additionally, as more automakers release extended-range vehicles, Li Auto’s competitive edge may diminish. Its shift toward artificial intelligence is another significant step, and its progress warrants close observation.

2. Aion Surges to Second Place, Defying Expectations

Aion, backed by GAC Group, recorded sales of 46,851 units in December and a total of 412,943 units for 2024. With GAC’s strong support in R&D and manufacturing, Aion’s product lineup covers multiple segments, offering competitive pricing and performance. Its ability to closely trail Li Auto in sales underscores its strong market competitiveness.

Analysis:

Aion has historically relied heavily on the B2B market, impacting its brand perception. The arrival of models like the Aion UT aims to shed its “ride-hailing car” label. Whether this shift translates into stronger sales and improved reputation will determine its future success.

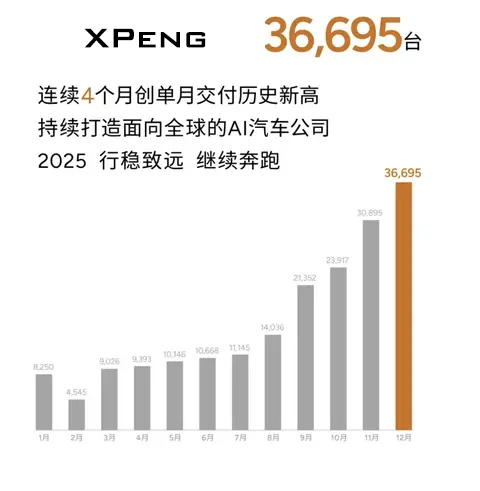

3. Leapmotor and XPeng Crack the Code for Blockbuster Models

Leapmotor and XPeng secured third and fourth places, respectively. Leapmotor sold 42,517 units in December and 293,724 units for the year, while XPeng reported December sales of 36,695 units, with a yearly total of 190,068 units.

Analysis:

Both brands achieved a significant turnaround in 2024. Leapmotor’s balanced focus on product features, intelligent technologies, and cost-effectiveness has driven its success. Meanwhile, XPeng saw explosive growth thanks to the popularity of its M03 and P7+ models. However, both brands need to focus on product differentiation, cost control, quality, and production stability to sustain their momentum.

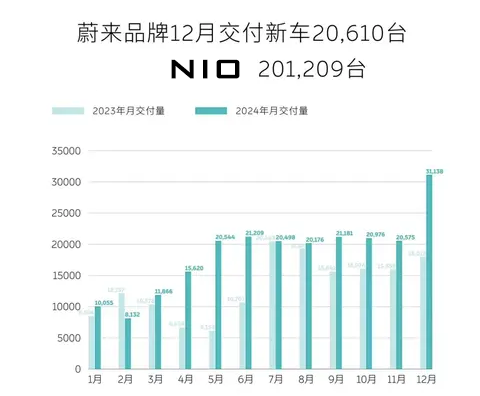

4. Deepal and NIO Hold Steady but Need a Breakthrough

Deepal and NIO ranked fifth and sixth, respectively. Deepal sold 36,577 units in December and 243,894 units for the year, while NIO (including its sub-brand ALPS) achieved a record-breaking December with 31,138 units, bringing its annual sales to 221,970 units.

Analysis:

Deepal has gained traction with its unique design and value-for-money products, performing well under Changan Auto’s umbrella. NIO’s launch of the ALPS brand has added volume to its sales. However, ALPS, aimed at the value segment, is expected to deliver greater support in terms of sales. Whether this potential is realized depends on expanded production capacity in 2025.

5. Zeekr and Xiaomi Show Promise for the Top Tier in 2025

Zeekr reported December sales of 27,190 units and an annual total of 222,123 units, while Xiaomi’s December sales exceeded 25,000 units, with a total of 135,000 units for the year.

Analysis:

Zeekr achieved record-high sales in 2024 but faced controversies surrounding several new models. Following its merger with Lynk & Co, Zeekr’s trajectory in 2025 remains a key point of interest. Xiaomi, the “newest player,” ranked eighth with just one model, yet its rapid success (135,000 units in nine months) is unprecedented. With the Xiaomi SUV set for release in 2025 and a sales target of 300,000 units, the brand’s potential is evident, bolstered by CEO Lei Jun’s popularity and strong marketing strategies.

6. Voyah and Arcfox Need to Step Up

Voyah and Arcfox delivered 12,136 and 12,032 units in December, with annual sales of 85,697 and 81,017 units, respectively.

Analysis:

Despite growth, these brands lag behind their peers. Both need to enhance their market competitiveness. Voyah should focus on the high-end MPV segment, while Arcfox can leverage its Magna-backed driving performance. Precision in market strategies could unlock further growth in 2025.

Conclusion:

While all emerging EV makers showed growth in 2024, disparities between brands are becoming more apparent. With Li Auto betting heavily on AI, Xiaomi introducing its new YU7, and the competition intensifying, 2025 will be a test of each brand’s overall strength in marketing, product innovation, and technology.

If you want to buy a EV from China,you’ve come to the right place. Chinacarhub is your trusted partner in importing the REEVs, plug-in hybrids, and pure EVs. With a selection of 60+ worldwide EV brands and efficient, cost-effective shipping, we make the process seamless.

Please explore our blog for the latest news and offers from the EV market.