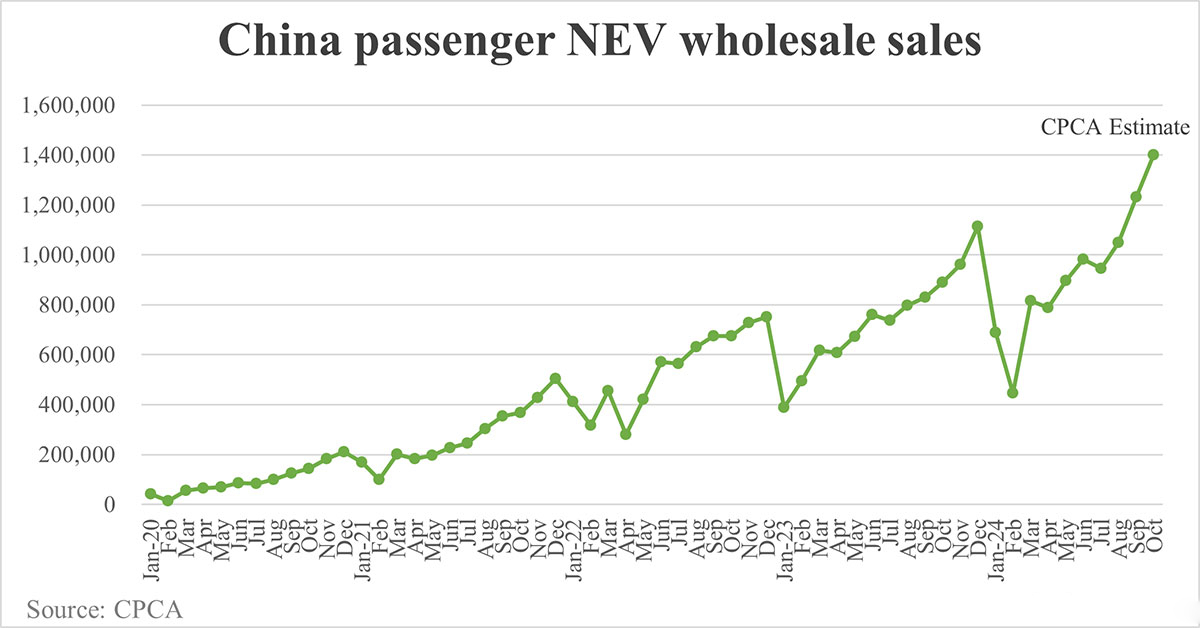

China's NEV Market Surpasses Records with 1.4 Million Wholesale Sales in October: A Deep Dive into the Factors Driving Growth

China’s new energy vehicle (NEV) market has achieved a new milestone, reaching an estimated 1.4 million units in wholesale sales in October 2024, according to data from the China Passenger Car Association (CPCA). This represents an impressive 58% increase compared to the same month last year and a 14% growth from September. The recent surge underscores the influence of government incentives and regional subsidies aimed at promoting cleaner transportation options and accelerating the country’s shift towards sustainability.

Government Support and Regional Subsidies Fuel NEV Growth

Government policies have been a significant catalyst for NEV adoption in China, especially with the recent implementation of vehicle replacement subsidies across all provinces. These incentives encourage consumers to trade in older, more polluting vehicles for new NEV models, making it more affordable for people to access advanced, environmentally friendly technology. This policy shift is intended not only to reduce emissions but also to stimulate the automotive market, which saw notable growth in 2024 as these incentives took effect nationwide.

Market Dynamics: Leading Automakers and Top Models

In October, major NEV manufacturers such as BYD, Geely, and Tesla China continued to lead the market. BYD alone contributed over 500,000 units, Geely sold around 108,000 units, and Tesla China accounted for approximately 68,000 units. Together, these top players helped achieve the record-breaking monthly sales figure of 1.4 million units, marking the fourth instance within the year that NEV sales exceeded one million units in a single month.

This upward trajectory is reflective of a broader trend within China’s automotive landscape, where NEVs, particularly entry-level battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), are becoming increasingly popular among consumers. By the end of October, NEVs represented over 60% of new car purchases through trade-in programs, highlighting a substantial demand across various consumer demographics.

NEV Categories and Their Market Shares

The NEV market in China encompasses battery electric vehicles, plug-in hybrid electric vehicles, and fuel cell vehicles, though BEVs and PHEVs currently dominate. Detailed sales data for each category is expected to be released by the CPCA later this month, but early estimates show a strong consumer preference for entry-level electric models. This shift is consistent with the government’s dual goal of encouraging low-emission vehicles and making NEVs more accessible to the general public.

Implications for China’s Automotive Market and Future Prospects

The consistent growth in NEV sales is more than a passing trend; it represents a solid transformation in consumer behavior driven by environmental consciousness and supported by advantageous policies. With the government’s commitment to achieving peak carbon emissions by 2030 and carbon neutrality by 2060, the NEV sector is poised for long-term growth, setting a standard for other countries striving to transition to greener technologies.

As China’s NEV market continues to break records, the landscape of the automotive industry is being reshaped. The country’s proactive policies, consumer willingness to adopt NEVs, and the competitive landscape among manufacturers suggest that this trend is likely to persist, positioning China as a global leader in clean automotive technology.